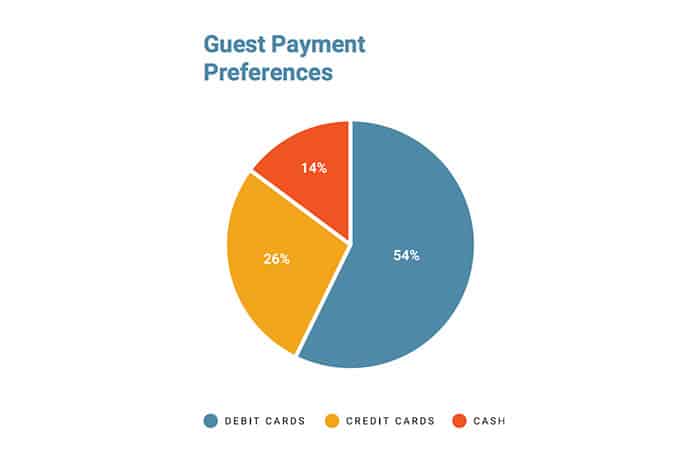

Cash is no longer king. Around the world, consumers choose to make more and more card-based payments for goods and services.According to a 2018 survey, 54% of consumers prefer using debit cards; 26% opt for credit cards, and only 14% prefer cash.

As consumers, we don’t often think about what our payment preferences mean for retailers. But in order to accept cards, merchants must make several payments, including processor fees, card association dues, and Interchange costs.

As restaurants face an ever-growing percentage of card-based transactions, finding cost-saving opportunities becomes paramount. By partnering with a technology partner that supports PIN-Debit technology, restaurants can identify significant cost-saving opportunities.

The Opportunity

Multiple options exist for card-based transactions today, and each has different cost associations for merchants that accept these types of payments. Both credit and debit cards route payments over systems called rails. Merchants must pay an Interchange fee for the privilege of using those payment rails.

Over time, merchants sued credit and debit card networks, citing the exorbitant Interchange costs they were charging. In response, congress passed the Durbin Amendment. Under this legislation, Interchange fees for debit transactions are priced more favorably for retailers than credit transactions, because debit is a more secure form of payment.

Debit payments can happen in two ways: by providing a signature and effectively treating the debit card as a credit card, or by capturing the cardholder’s personal identification number, or PIN. By capturing PINs, merchants can route transactions on any network that offers them the best price. Thus, restaurants that process a high volume of card-based transactions each year can realize significant cost-savings by optimizing for their customers’ use of PIN-Debit payment methods.

The Solution

Presto Pay At Table is one of the first tablet devices in the restaurant industry—and one of the only ones that supports PIN-Debit technology. Traditional restaurants, which process payments at a terminal out of sight of the guests, cannot support PIN-Debit payments, because the person who knows the PIN number (i.e., the restaurant guest) does not have access to the terminal.

A tabletop device like Presto’s solves this problem. Diners can easily insert their cards into the Presto tablet, then input their PINs on the built-in pin pad.

Many other tabletop tablets don’t support PIN-Debit technology, because many do not have a physical pin pad; rather, they have touchscreens.

“The problem is that a standard tablet is not built for payments,” explains David Wood, VP of Payments at Presto. “When you start inputting numbers on a screen, you need to worry about malicious software. Tablets are not really built to control or do anything about malware. So, the challenge in building a secure way to input PINs via a touchscreen is huge. That’s why we made the design decision to go with the tried and true pin pad, and we were certified in short order.”

By deploying Presto’s PIN-Debit-supporting tablets, restaurants can enable their customers to easily pay by PIN-Debit. In turn, this results in significant cost-saving opportunities for the restaurant. A large restaurant chain with 700 locations, for example, could save over $1 million per year just by deploying PIN-Debit technology.

Enabling PIN-Debit transactions is just one of the myriad ways the Presto platform helps customers realize cost-savings. Presto also allows restaurants to generate direct revenue via games installed on tablets; increase productivity for servers, which results in improved guest satisfaction, quicker table turns, and labor savings; and capture guest feedback in real-time. Please contact us to get detailed information or to schedule a demo.